| Index | Price | Change | % Chg |

| NIFTY 50 | 17616.30 | –45.85 | -0.26% |

| NIFTY BANK | 40513.00 | -142.05 | -0.35% |

| BSE SENSEX | 59708.08 | +158.18 | +0.27% |

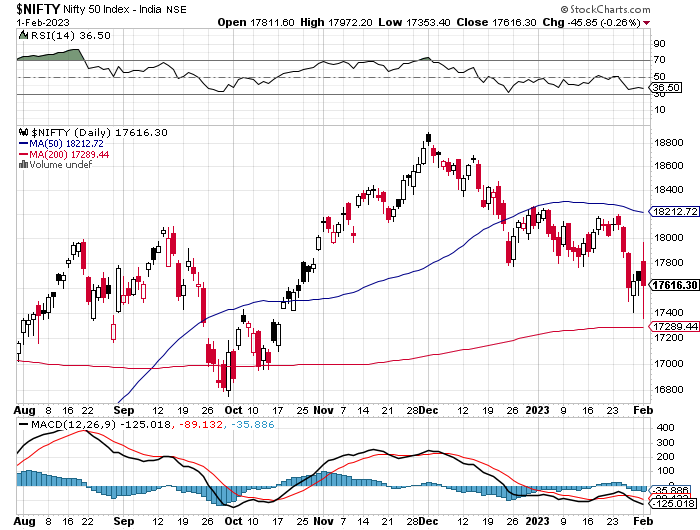

At the close, the Nifty 50 was at 17,616.30 down by 0.26%

Today, the NSE Nifty 50 index started in a high and ended in a red, down by 0.26 percent. The index closed below 17620 points. This indicates that the stock market is showing signs of instability in the current economic climate. Although the fall wasn’t substantial, it is a sign of caution for investors to be more cautious in their investments. With investor sentiment low and market volatility high, it’s important to keep an eye on these developments and adjust investment strategies accordingly.

Buzzing

Indian shares ended the day lower on Wednesday, with the decline being led by insurance companies following the announcement of the Union budget. The budget proposed to limit tax exemptions for insurance proceeds, which likely had a negative impact on the insurance sector. Additionally, stocks of Adani Group companies also experienced a significant decline, contributing to the overall negative performance of the stock market. These events caused the shares to reverse earlier gains and close lower for the day.

Adani Enterprises, Adani Transmission, Adani Ports and Special Economic Zone, Adani Green Energy, Adani Total Gas, Adani Power, and Adani Wilmar, which are all companies under the Adani Group, experienced declines between 2-28 percent. This suggests that the overall performance of these companies was negative for the day.

Investors should keep a close eye on how these companies are adapting to the changing dynamics in order to ensure that their investments remain safe. It is important for them to make well-informed decisions about investing in these companies by analyzing their financial performance as well as other factors such as competition from other players in the industry.

The decline in stocks of Adani Group companies last week was likely due to the publication of a report by American short-seller Hindenburg Research. The report accused the company of using tax havens and raised concerns about the company’s debt. These allegations likely had a negative impact on investor confidence in the company and caused a decline in the value of its stocks.

Bank Nifty: Down by 0.35%

The Bank Nifty, which is an index of banking stocks listed on the National Stock Exchange of India, started the day in positive territory but ended the day down 0.35 percent, closing in the red at 40,513.00 points. On the other hand, the BSE Sensex, which is a stock market index that represents the performance of stocks listed on the Bombay Stock Exchange, started the day up by 0.27 percent and closed in green at a high of 59,708.08 points. This suggests that while the Bank Nifty had a negative performance for the day, the BSE Sensex had a positive performance.

Bank Nifty

The Nifty Banking sector had some gainers and some losers for the day. The gainers included ICICI Bank with a 2.18% increase, HDFC Bank with a 1.37% increase, and Kotak Bank with a 0.69% increase. On the other hand, the biggest losers in the sector included Bank of Baroda with a 8.04% decline, PNB with a 6.07% decline, SBIN with a 4.79% decline, IndusInd Bank with a 3.93% decline, and Bandhan Bank with a 2.95% decline. These results suggest that some banking stocks performed better than others for the day.

The Indian stock markets had a rough trading session today when the Nifty PSU Bank declined 5.68% and Nifty Metal fell 4.50%. This dip in the indices can be attributed to the prolonged to economic uncertainty.

The sell off in Metal, Media and Oil & Gas stocks that dragged the indices lower. Metal stocks, which had previously been stable, resulting in a 4.50% drop in Nifty Metal.

In spite of this, some stocks were able to maintain their gains, such as FMCG and IT giants, who have been relatively less affected. It will be interesting to observe if these stocks will be able to sustain their gain in the coming days.

To sum up, the benchmark indices of the Indian stock market ended lower today. The major forces behind this decline were the Metal, Media and Oil & Gas sectors, as well as the Nifty PSU Bank declining 5.68% and Nifty Metal falling 4.50%. It is important for investors to remain vigilant and to keep an eye on the developments in the market in the coming days.

Advance Decline Ratio

Today, the advance-decline ratio was 0.43, and the market breadth was negative. The volatility index India Vix decreased by 0.56 percent to settle at 16.78 and the FIIs were net buyers today.

DAILY MARKET ACTION

Advancers – 668

Decliners – 1568

52Wk High – 44

52Wk Low – 88

High Band Hitters – 101

Low Band Hitters – 93

200d SMA – 17290

50d SMA – 18213

20d SMA – 17926

Top Gainers and Losers Stocks

The top gainers were ICICI Bank (+2.18%), JSW Steel (+2.09%), ITC (+2.06%), Tata Steel (+1.96%), and Britannia (+1.68%).

The top losers were Adani Enterprises (-26.70%), Adani Ports (-17.73%), HDFC Life (-10.79%), SBI Life (-8.61%), and Bajaj Finserv (-5.45%).

Top Gainers and Losers Sector

The top gainers sector were FMCG (+1.13%), and IT (+0.93%).

The top losers sector were Metal (-4.50%), Media (-2.70%), Oil & Gas (-2.03%), Realty (-0.94%), and Auto (-0.88%).

The Nifty Midcap 50 was down by 0.96 percent, while the Nifty Small Cap 50 down by 1.36 percent on the day.

The Nifty Midcap 50 index currently closed at 8,554.70, while the Nifty Small Cap 50 index currently closed at 4,238.80.

SECTORS – NOTABLE ACTION

FMCG +1.13%

IT +0.93%

METAL -4.50%

MEDIA -2.70%

OIL & GAS -2.03%

Stocks Ban List

(SEBI) F&O ban list (AMBUJACEM open at 409.20 and close at 334.10), are not currently on the stock exchange.

The Securities and Exchange Board of India (SEBI) has banned AMBUJACEM, from trading in the futures and options (F&O) segment of the stock exchange.

Daily Pivots

| S2 | S1 | R1 | R2 |

| 17029 | 17322 | 17941 | 18266 |

Nifty trading range has been within the 17320 to 17950 range.

Read previous -Daily Insights- here

Marginal Gains

Market Bounced Back

Nifty – Free Fall !

This article is only for educational purposes and is not an investment advice.