| Index | Price | Change | % Chg |

| NIFTY 50 | 18,285.40 | -62.60 | -0.34% |

| NIFTY BANK | 43,677.85 | -276.60 | –0.63% |

| BSE SENSEX | 61,773.78 | –208.01 | –0.34% |

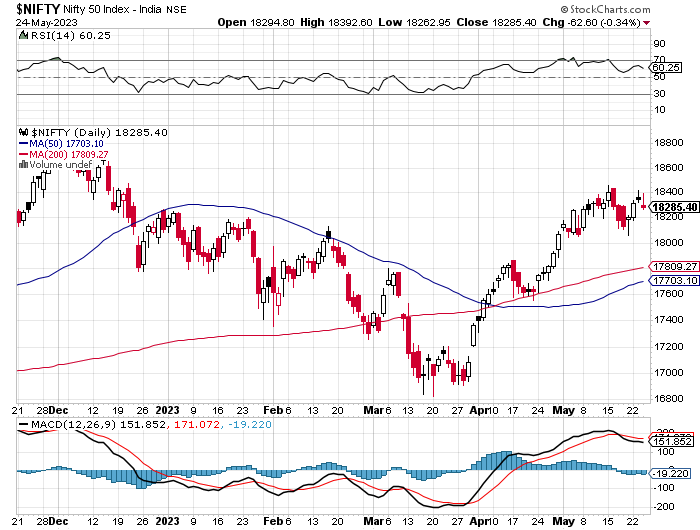

At the close, the Nifty 50 was at 18,285.40 down by 0.34%

Lackluster beginning for NSE Nifty 50 on this day, with a modest descent of 0.34 percent. However, as the day progressed, the index’s performance continued to decline, ultimately ending on a somber note with closing figures in the red. It is noteworthy that Nifty, a prominent benchmark index, fell below the significant threshold of 18300, adding to the significance of this eventful trading day.

The financial markets embarked on a rollercoaster ride, exhibiting volatility as they sought equilibrium and settled marginally lower, affording themselves a momentary respite following a recent surge. Initially experiencing a downtick, the Nifty index traversed within a defined range, ultimately finding solace near the day’s nadir at the significant level of 18,285.40. Most sectors dutifully adhered to the prevailing trend, succumbing to downward pressure, with notable declines observed in the metal, banking, and financial domains.

Simultaneously, the broader market displayed a commendable performance, managing to conclude the day either unchanged or modestly in positive territory, thus perpetuating their track record of outperformance. As we enter a phase where major earnings announcements are now behind us, market participants eagerly turn their gaze towards global markets for cues, yet the clarity they seek remains elusive at present. Amidst this uncertainty, sectors such as banking and financials, carrying substantial weight within the index, assert a considerable influence over market movements.

Bank Nifty: Down by 0.63%

The Bank Nifty began its trading session on a rather gloomy note, with its opening figures displaying a striking shade of red. Throughout the day, it continued its downward trend, ultimately culminating with a decline of 0.63 percent, settling at a noteworthy figure of 43,677.85. Similarly, the renowned BSE Sensex experienced a parallel narrative, as it embarked on its course with a reduction of 0.34 percent. Its performance mirrored that of its counterpart, as it too found itself painted in the hues of crimson at the end of the day, converging at a meager level of 61,773.78.

The stock market’s performance was not as optimistic as investors had hoped. The Bank Nifty and BSE Sensex both experienced a decline in their opening figures, setting the tone for a rather somber trading session.

In the realm of sectorial performance, the Consumer Durables sector emerges as the frontrunner, showcasing a notable gain of 1.40%. Within this sector, Dixon Technologies (India) Limited exhibits a remarkable surge of 6.94%, accompanied by Amber Enterprises India Limited with a gain of 4.48%, and Orient Electric Limited with a gain of 4.15%. These companies within the Consumer Durables sector demonstrate a commendable trajectory, positioning them favorably amidst market fluctuations.

Conversely, the Metal sector experiences a decline, claiming the title of the top loser with a decrease of 1.56%. Within this sector, Adani Enterprises Limited witnesses a significant loss of 6.03%, while Ratnamani Metals & Tubes Limited grapples with a decline of 3.47%. Jindal Steel & Power Limited also experiences a decrease, albeit to a lesser extent, with a loss of 2.03%. These companies within the Metal sector confront challenges, reflecting the dynamic nature of the market and its impact on sectorial performance.

The dichotomy between the Consumer Durables sector’s positive strides and the Metal sector’s downturn provides a glimpse into the intricate nature of market movements.

Bank Nifty

The Nifty Banking sector had some gainers and some losers for the day.

The gainers included Bandhan Bank with a 2.52% increase, IndusInd Bank with a 1.06% increase, AU Bank with a 0.30% increase, Axis Bank with a 0.20% increase and IDFC First Bank with a 0.15% increase. On the other hand, the biggest losers in the sector included Federal Bank with a 1.79% decline, Punjab National Bank with a 1.48% decline, HDFC Bank with a 1.36% decline, ICICI Bank with a 1.29% decline, and Kotak Bank with a 0.69% decline. These results suggest that some banking stocks performed better for the day.

Buzzing

The share price of Sun Pharmaceutical Industries Ltd. exhibited a notable ascent of 2.22% when juxtaposed with its preceding closing value of Rs 931.60. Currently, the stock is valued at 952.30, reflecting its most recent trade. Over a span of three years, this stock has yielded a remarkable return of 98.47%, surpassing the performance of the Nifty 100 index, which recorded a return of 97.04% during the same period. Moreover, a 5-day moving crossover signal emerged in the market just yesterday, signaling a potential shift in market trends.

It is worth noting that historical data reveals an average price decline of -2.31% within a span of seven days following the emergence of this signal over the course of the past five years. These figures serve as valuable insights for investors seeking to assess the potential impact and implications of this recent market occurrence.

The share price of Dr. Reddy’s Laboratories Ltd. demonstrated a commendable upswing of 1.32% in relation to its previous closing value of Rs 4,460.55. Currently, the stock is trading at 4,519.25, reflecting its most recent trade. Over a span of three years, this stock has delivered a respectable return of 14.58%, albeit falling short of the performance exhibited by the Nifty 100 index, which recorded a return of 97.04% during the same period.

Impressively, the company has showcased a noteworthy annual revenue growth rate of 16.78%, surpassing its three-year Compound Annual Growth Rate (CAGR) of 12.22%. Furthermore, in the fiscal year ending on March 31, 2023, Dr. Reddy’s Laboratories Ltd. achieved a Return on Equity (ROE) of 19.35%, outperforming its five-year average of 14.06%. This signifies the company’s ability to generate higher returns for its shareholders.

Intriguingly, historical data spanning a remarkable 18-year period reveals that only 1.12% of trading sessions witnessed intraday gains exceeding 5%. Such occurrences highlight the rarity of substantial intraday price movements, further emphasizing the significance of this recent development.

These statistics and performance metrics serve as a valuable tool for investors seeking a comprehensive evaluation of Dr. Reddy’s Laboratories Ltd. and its standing within the market landscape.

Buzz

The domestic market bore witness to a fleeting surge, its radiance dimmed by the prevailing undercurrents of subdued global market sentiment. The upswing was cut short as US Treasury yields ascended, propelled by apprehensions surrounding the protracted US debt ceiling negotiations and the discernibly hawkish remarks emanating from officials within the US Federal Reserve. These developments, in turn, diminished the prospects of an imminent pause in interest rate adjustments.

Across the Atlantic, European markets experienced a downturn of their own, catalyzed by the revelation of UK inflation figures surpassing expectations. This unforeseen escalation in inflationary pressures prompted speculations of an augmented frequency of rate hikes by the Bank of England, subsequently adding to the market’s trepidation.

In the face of such global headwinds, the domestic market’s brief rally was inevitably overshadowed, serving as a reminder of the interconnectedness and the influence exerted by external factors on market dynamics.

During Tuesday’s trading session, the Indian rupee displayed a limited trading range and ultimately concluded the day with a marginal appreciation of 2 paise against the US dollar, settling at 82.82 (provisional). This movement occurred amidst a subdued trend observed in the domestic equities market.

Forex traders noted that the local unit’s gains were curbed due to the prevailing strength of the American currency. In the interbank foreign exchange market, the Indian rupee commenced the day at 82.82 against the US dollar. Throughout the course of the trading session, it reached a high of 82.76 and a low of 82.84.

Ultimately, the Indian rupee settled at 82.82 (provisional), marking a slight increase of 2 paise compared to its previous close. In the preceding trading session on Monday, the rupee had closed at 82.84 against the US dollar.

The rupee’s narrow trading range and modest appreciation underscore the cautious sentiment prevailing in the market, with traders closely monitoring factors influencing foreign exchange dynamics and keeping an eye on the broader equities landscape for further cues.

Advance Decline Ratio

Today, the advance-decline ratio was 0.91, and the market breadth was negative. The volatility index India Vix increased by 4.02 percent to settle at 13.11 and the FIIs were net buyers today.

DAILY MARKET ACTION

Advancers – 1079

Decliners – 1191

52Wk High – 66

52Wk Low – 10

High Band Hitters – 65

Low Band Hitters – 46

200d SMA – 17810

50d SMA – 17703

20d SMA – 18198

Top Gainers and Losers Stocks

The top gainers were Sun Pharmaceutical (+1.98%), Dr. Reddy (+1.31%), ITC (+1.13%), IndusInd Bank (+1.06%), and Titan (+0.99%).

The top losers were Adani Enterprises (-6.03%), Adani Ports (-2.21%), Tata Motors (-1.49%), HDFC Bank (-1.36%), and ICICI Bank (-1.29%).

Top Gainers and Losers Sector

The top gainers sectors were Consumer Durables (+1.40%), Pharma (+1.03%), Media (+0.55%), FMCG (+0.48%), and Oil & Gas (+0.12%).

The top losers sectors were Metal (-1.56%), Financial Services (-0.80%), and Realty (-0.01%).

The Nifty Midcap 50 was down by 0.20 percent, while the Nifty Small Cap 50 was down by 0.13 percent on the day.

The Nifty Midcap 50 index currently closed at 9,267.60, while the Nifty Small Cap 50 index currently closed at 4,483.45.

SECTORS – NOTABLE ACTION

CONSUMER DURABLES +1.40%

PHARMA +1.03%

MEDIA +0.55%

METAL -1.56%

FINANCIAL SERVICES -0.80%

REALTY -0.01%

Stocks Ban List

(SEBI) F&O ban list (DELTACORP open at +234.05 and close at -233.65), and (IBULHSGFIN open at -111.50 and close at +112.00) are not currently on the stock exchange.

The Securities and Exchange Board of India (SEBI) has banned DELTACORP, and IBULHSGFIN, from trading in the futures and options (F&O) segment of the stock exchange.

A stock enters the Ban List if its MWPL is above 95%. Implying that, Ban List shows the Futures and Options (FnO ) stocks whose combined open interest in all FnO contracts for a given period crosses 95% of Market-Wide Position Limit.

It seems that BHEL, and PNB may be at risk of being added to the ban list.

MANAPPURAM has the possibilites of exited from ban list.

Daily Pivots

| S2 | S1 | R1 | R2 |

| 18184 | 18235 | 18364 | 18443 |

As per the above pivots data, 18230 to 18370 is the Nifty 50 trading range.

Read previous -Daily Insights- here

Market Concludes with Modest Gains amidst Late Selling Pressure

Market Inches Higher on US Debt-Ceiling Hopes

INCOME TAX SAVING Senior Citizen Saving Scheme(SCSS)

This article is only for educational purposes and is not an investment advice.