| Index | Price | Change | % Chg |

| NIFTY 50 | 18,181.75 | -104.75 | -0.57% |

| NIFTY BANK | 43,698.70 | -205.00 | –0.47% |

| BSE SENSEX | 61,560.64 | –371.83 | –0.60% |

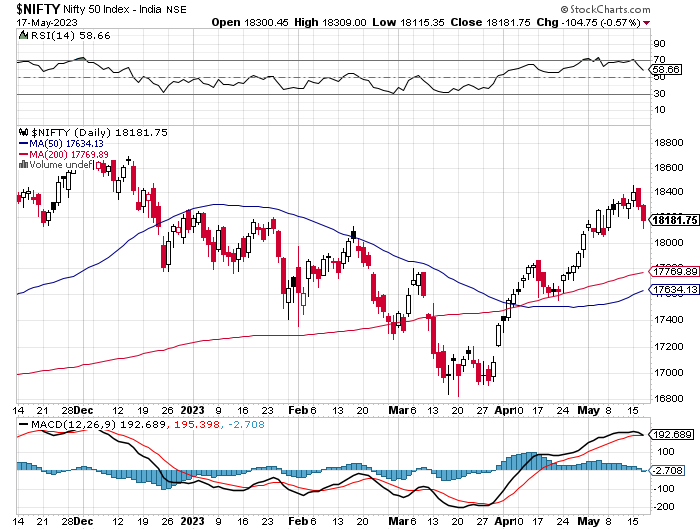

At the close, the Nifty 50 was at 18,181.75 down by 0.57%

Today, the NSE Nifty 50 commenced with a significant downward gap, experiencing a 0.57% decline and ultimately closing in the negative territory. The Nifty index concluded the day below the 18200 mark.

Amid concerns surrounding the debt ceiling crisis in the United States, profit booking persisted for the second consecutive session on May 17, resulting in the Nifty index closing below the significant 18,200 level. This downward movement was influenced by the mixed performance of global markets.

In recent times, Nifty has encountered a shift in sentiment, manifesting as a downward movement that caused it to breach the ascending channel on the hourly chart. This development suggests an increase in bearish speculation. The correction witnessed is in line with expectations, considering the substantial upward rally Nifty had experienced without undergoing a significant retracement. Looking ahead, a potential post-correction rebound may propel Nifty towards the 18300 level, where bears could be poised to re-engage the market. A rejection from this level may reignite selling pressure. Notably, immediate support can be identified at 18100.

Within the sectorial landscape, Auto emerged as the leading gainer, exhibiting a 0.09% increase. Among the notable performers in this sector, TUBE INVESTMENTS OF INDIA LIMITED gained 1.41%, HERO MOTOCORP LIMITED saw a gain of 1.34%, and MRF LIMITED experienced a gain of 1.20%. Conversely, Media encountered the highest decline, recording a loss of 2.09%. Notable losers within this sector include PVR INOX LIMITED with a loss of 4.93%, DISH TV INDIA LIMITED with a loss of 2.86%, and TV18 BROADCAST LIMITED with a loss of 2.01%.

Bank Nifty: Down by 0.47%

The Bank Nifty initiated the day in a bearish manner, facing a 0.47% decline and ultimately settling in the negative zone at 43,698.70. Similarly, the BSE Sensex witnessed a 0.60% downturn, concluding the session at a meager 61,560.64 in the red.

Amidst a cautious atmosphere, the markets remained entrenched in negative territory, with prudent investors opting to secure profits following the recent surge. The lackluster economic indicators emanating from both the United States and China have reignited apprehensions regarding a decelerating economy and subsequently stoked fears of a potential recession. These prevailing concerns have instilled a sense of unease among investors, leading to heightened uncertainty about the future trajectory.

As of May 17, 2023, Foreign Institutional Investors/Foreign Portfolio Investors (FII/FPI) recorded a buy value of Rs. 7,478.25 crore and a sale value of Rs. 7,328.92 crore, resulting in a net value of Rs. 149.33 crore.

On the same date, Domestic Institutional Investors (DII) registered a buy value of Rs. 6,046.80 crore and a sale value of Rs. 6,250.67 crore, leading to a net value of -Rs. 203.87 crore.

Bank Nifty

The Nifty Banking sector had some gainers and some losers for the day.

The gainers included IndusInd Bank with a 0.96% increase, Federal Bank with a 0.63% increase, Punjab National Bank with a 0.41% increase, State Bank of India with a 0.15% increase, and AU Bank with a 0.11% increase. On the other hand, the biggest losers in the sector included Kotak Bank with a 1.95% decline, ICICI Bank with a 0.42% decline, HDFC Bank with a 0.39% decline, IDFC First Bank with a 0.37% decline, and Axis Bank with a 0.28% decline. These results suggest that some banking stocks not performed better for the day.

Buzzing

Hero MotoCorp Ltd. witnessed a notable surge in its share price, marking a 1.38% increase from its previous closing value of Rs 2,686.00. The stock of Hero MotoCorp Ltd. concluded its latest trading session at Rs 2,722.95. Over a 3-year period, the stock delivered a return of 22.45%, which pales in comparison to the Nifty 100’s return of 95.89%. However, the company displayed commendable annual revenue growth of 15.35%, surpassing its 3-year compound annual growth rate (CAGR) of 4.97%. Remarkably, only 1.03% of trading sessions over the past 18 years experienced intraday declines exceeding 5%.

IndusInd Bank Ltd. witnessed a notable uptick in its share price, marking a 1.20% increase from its previous closing value of Rs 1,220.30. The stock of IndusInd Bank Ltd. concluded its latest trading session at Rs 1,234.95. Remarkably, the stock delivered an impressive 3-year return of 191.45%, outperforming the Nifty 100’s return of 95.89%. Furthermore, the company exhibited a commendable annual revenue growth rate of 16.51%, surpassing its 3-year compound annual growth rate (CAGR) of 7.54%. IndusInd Bank Ltd. reported a YoY increase of 21.28% in advances, surpassing its 5-year CAGR of 9.24%. Over the course of the last 18 years, only a mere 3.42% of trading sessions experienced intraday gains exceeding 5%.

Buzz

In early trading on Wednesday, the Indian rupee experienced a depreciation of 10 paise, reaching a value of 82.35 against the US dollar. This decline was attributed to the robust performance of the American currency in the global market and a downward trend observed in the domestic equities.

At the interbank foreign exchange, the domestic unit commenced the session at 82.29 against the dollar and subsequently slipped to 82.35, indicating a decrease of 10 paise in comparison to its previous closing value.

During the preceding day, the rupee settled at 82.25 against the dollar.

The dollar index, which assesses the strength of the US dollar against a basket of six currencies, witnessed a marginal increase of 0.04% to reach 102.60.

Meanwhile, Brent crude futures, the international benchmark for oil prices, experienced a modest upswing of 0.11%, reaching $74.99 per barrel.

Advance Decline Ratio

Today, the advance-decline ratio was 0.76, and the market breadth was negative. The volatility index India Vix decreased by 1.41 percent to settle at 13.11 and the FIIs were net buyers today.

DAILY MARKET ACTION

Advancers – 978

Decliners – 1291

52Wk High – 76

52Wk Low – 17

High Band Hitters – 49

Low Band Hitters – 39

200d SMA – 17770

50d SMA – 17634

20d SMA – 18053

Top Gainers and Losers Stocks

The top gainers were Hero MotoCorp (+1.34%), ITC (+0.97%), IndusInd Bank (+0.96%), UPL (+0.91%), and Bharti Airtel (+0.75%).

The top losers were Kotak Bank (-1.95%), Apollo Hospitals (-1.74%), SBI Life (-1.65%), TCS (-1.51%), and HCL Technologies (-1.35%).

Top Gainers and Losers Sector

The top gainers sectors were Auto (+0.09%), and FMCG (+0.06%).

The top losers sectors were Media (-2.09%), Realty (-1.33%), IT (-0.97%), Metal (-0.89%), and Financial Services (-0.71%).

The Nifty Midcap 50 was down by 0.27 percent, while the Nifty Small Cap 50 was up by 0.09 percent on the day.

The Nifty Midcap 50 index currently closed at 9,244.65, while the Nifty Small Cap 50 index currently closed at 4,493.10.

SECTORS – NOTABLE ACTION

AUTO +0.09%

FMCG +0.06%

MEDIA -2.09%

REALTY -1.33%

IT -0.97%

Stocks Ban List

(SEBI) F&O ban list (BALRAMCHIN open at -380.00 and close at +380.00), (MANAPPURAM open at +113.00 and close at -111.20), (GNFC open at +648.50 and close at +654.45), (DELTACORP open at +227.80 and close at -222.25), and (PNB open at -49.15 and close at -49.00), are not currently on the stock exchange.

The Securities and Exchange Board of India (SEBI) has banned BALRAMCHIN, MANAPPURAM, GNFC, DELTACORP, and PNB from trading in the futures and options (F&O) segment of the stock exchange.

A stock enters the Ban List if its MWPL is above 95%. Implying that, Ban List shows the Futures and Options (FnO ) stocks whose combined open interest in all FnO contracts for a given period crosses 95% of Market-Wide Position Limit.

It seems that IBULHSGFIN, L&TFH, LICHSGFIN, RBLBANK, ABFRL and CANBK and may be at risk of being added to the ban list.

BHEL has the possibilites of exited from ban list.

Daily Pivots

| S2 | S1 | R1 | R2 |

| 18008 | 18095 | 18289 | 18396 |

As per the above pivots data, 18090 to 18300 is the Nifty 50 trading range.

Read previous -Daily Insights- here

Market Opens Flat, Experiences Selling Pressure

Indian Equity Benchmarks Reach 5-Month High, Extend Winning Streak

Flat Ending to Volatile Session in Markets

This article is only for educational purposes and is not an investment advice.