| Index | Price | Change | % Chg |

| Nifty 50 | 19,901.40 | -231.90 | -1.15% |

| Nifty Bank | 45,384.60 | –595.25 | -1.29% |

| BSE SENSEX | 66,800.84 | –796.00 | –1.18% |

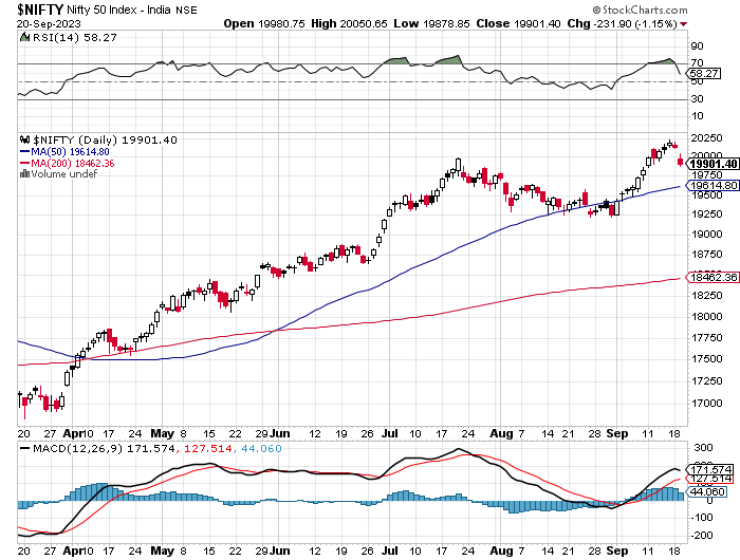

At the close, the Nifty 50 was at 19,901.40 down by 1.15%

In recent trading sessions, the Indian equity market has witnessed a turbulent ride, characterized by an initial gap-down opening and sustained selling pressure throughout the day. Major indices, weighed down by prominent players across diverse sectors, have registered consecutive declines for the second day in a row, concluding near their day’s lowest levels. This heightened volatility emphasizes the necessity for investors to exercise caution in the current market climate.

The Nifty 50 index commenced the day on a bearish note, ultimately closing with a 1.15 percent loss, signaling a prevailing bearish sentiment. It’s notable that the Nifty has dipped below the psychologically significant 20,000 level. This correction had been anticipated for some time, primarily due to the escalating valuations that followed a recent surge. Consequently, investors are seizing opportunities to realize profits, especially in anticipation of the upcoming U.S. Federal Open Market Committee (FOMC) meeting, which holds the potential for global market repercussions.

Adding to market jitters are global concerns surrounding the ongoing tensions between the United States and Canada. Any escalation in this situation could send shockwaves through global markets, impacting Indian equities as well.

The domestic market’s vulnerability to external pressures is further exacerbated by the rise in U.S. bond yields and the strengthening U.S. dollar. Additionally, apprehensions persist regarding the forthcoming FED policy announcement and the potential trajectory of interest rates. Rising oil prices, another global variable, contribute to the prevailing uncertainty, highlighting the importance of a diversified investment strategy.

Bank Nifty: Down by 1.29%

The Bank Nifty, a critical gauge of the financial sector’s well-being, has entered a correction phase, marked by its inability to surpass the previous swing high, indicating underlying weakness. Today’s performance of the Bank Nifty reinforces these concerns, with underperformance primarily attributed to rising funding costs and a noticeable reduction in deposits, which has subsequently moderated its net yield.

Beginning the day on a bearish note, the Bank Nifty witnessed a decline of 1.29 percent and closed at 45,384.60, further emphasizing the downward trend. Similarly, the BSE Sensex, reflecting broader market sentiment, experienced a decline of 1.18 percent, concluding at a low of 66,800.84.

A Sea of Red with Metal Stocks Bearing the Brunt

In today’s market landscape, no sector emerged as a gainer, with all sectors uniformly closing in the red, highlighting pervasive market pressure. Among these sectors, the Metal sector stood out as the top loser, experiencing a notable decline of 1.63 percent. The sector’s underperformance can be attributed to specific company-level setbacks.

Taking a deeper dive into the Metal sector, several prominent players incurred significant losses today. Jindal Stainless Ltd. bore the brunt of the decline, registering a substantial loss of -3.63 percent. Meanwhile, JSW Steel Ltd. and Vedanta Ltd. also faced losses, with the former declining by -2.70 percent and the latter by -1.82 percent.

Bank Nifty

The Nifty Banking sector had some gainers and some losers for the day.

The gainers included AU Bank with a 3.83% increase, IDFC First Bank with a 1.13% increase, Federal Bank with a 0.34% increase, and Axis Bank with a 0.22% increase. On the other hand, the biggest losers in the sector included HDFC Bank with a 3.87% decline, Bank of Baroda with a 1.29% decline, IndusInd Bank with a 1.15% decline, State Bank of India with a 0.49% decline, and Bandhan Bank with a 0.36% decline. These results suggest that some banking stocks not performed better for the day.

Buzz

Rupee’s Resilience Amid Market Flux

In the early hours of Wednesday’s trading session, the Indian rupee displayed resilience, strengthening by 6 paise to reach a value of 83.26 against the US dollar. This upward trajectory was primarily driven by a combination of factors, including the relief provided by declining global crude oil prices and an increased appetite for riskier assets in the market. However, it’s important to acknowledge that the rupee’s ascent encountered certain challenges.

The drop in global crude oil prices had a positive impact on the rupee’s performance. As crude oil prices eased, it alleviated some of the pressure on India’s import costs, consequently strengthening the currency. Furthermore, the growing willingness of investors to embrace riskier assets led to increased demand for emerging market currencies, including the rupee.

Despite these favorable factors, the rupee faced headwinds in the form of a sell-off in domestic equity markets. Additionally, the US dollar maintained its strength against major global currencies, creating a competitive environment that somewhat restrained the rupee’s upward momentum.

The day began with the rupee opening at 83.22 against the US dollar in the interbank foreign exchange market. Although it briefly slipped to 83.26, it ultimately secured a 6 paise gain over its previous closing rate.

Buzzing

Coal India Ltd. has demonstrated impressive performance in recent trading sessions, with its share price showing a positive gain of 1.12%, climbing from Rs 281.25 to Rs 284.40. Beyond this short-term uptick, the company’s long-term financial performance is equally remarkable. Coal India Ltd. has achieved an annual revenue growth rate of 27.45%, surpassing its 3-year Compound Annual Growth Rate (CAGR) of 12.19%. This highlights the company’s ability to not only sustain but also accelerate its business operations successfully.

Furthermore, it’s worth noting that the company has maintained efficient financial management practices. With less than 1% of operating revenues allocated to interest expenses and only 35.74% allocated to employee costs for the fiscal year ending on March 31, 2023, Coal India Ltd. appears to be well-positioned for continued growth.

On the other hand, JSW Steel Ltd. experienced a -2.70% decline in its share price, closing at Rs 787.00, down from its previous close of Rs 808.80. Notably, technical indicators, including a 10-day moving average crossover and a 14-day moving average crossover, appeared on September 18, 2023. Historical data indicates that, on average, there has been a price decline of -2.6% within 7 days following the 10-day crossover signal and a -2.5% decline within 7 days following the 14-day crossover signal over the last 5 years.

Taking a closer look at the company’s financials, JSW Steel Ltd. has allocated 4.16% of its operating revenues to interest expenses and 2.36% to employee costs for the fiscal year ending on March 31, 2023.

Advance Decline Ratio

Today, the advance-decline ratio was 0.49, and the market breadth was negative. The volatility index India Vix increased by 2.69 percent to settle at 11.13 and the FIIs were net sellers today.

DAILY MARKET ACTION

Advancers – 774

Decliners – 1581

52Wk High – 79

52Wk Low – 11

High Band Hitters – 61

Low Band Hitters – 28

200d SMA – 18462

50d SMA – 19615

20d SMA – 19672

Top Gainers and Losers Stocks

The top gainers were Power Grid (+2.35%), Coal India (+1.12%), ONGC (+0.75%), Asian Paint (+0.57%), and Sun Pharmaceutical (+0.44%).

The top losers were HDFC Bank (-3.87%), JSW Steel (-2.70%), Reliance (-2.29%), BPCL (-2.07%), and UltraTech Cement (-2.06%).

Top Gainers and Losers Sector

The top losers sectors were Metal (-1.63%), Financial Services (-1.49%), Realty (-1.17%), Oil & Gas (-0.92%), and IT (-0.54%).

The Nifty Midcap 50 was down by 0.01 percent, while the Nifty Small Cap 50 was down by 0.71 percent on the day.

The Nifty Midcap 50 index currently closed at 11,594.70, while the Nifty Small Cap 50 index currently closed at 5,808.80.

SECTORS – NOTABLE ACTION

METAL-1.63%

FINANCIAL SERVICES -1.49%

REALTY -1.17%

Stocks Ban List

(SEBI) F&O ban list (DELTACORP open at -177.00 and close at -176.85), (PNB open at +76.80 and close at -76.45), (BALRAMCHIN open at -437.00 and close at +440.75), (BHEL open at -126.00 and close at -123.60), (CHAMBLFERT open at -281.00 and close at +282.25), (IBULHSGFIN open at +198.70 and close at -199.10), (ZEEL open at -268.00 and close at -264.60), (MANAPPURAM open at +143.20 and close at -139.70), (IEX open at -133.00 and close at -133.00), and (RECLTD open at +250.35 and close at +254.30) are not currently on the stock exchange.

A stock enters the Ban List if its MWPL is above 95%. Implying that, Ban List shows the Futures and Options (FnO) stocks whose combined open interest in all FnO contracts for a given period crosses 95% of Market-Wide Position Limit.

NMDC, INDUSTOWER, CANBK, RBLBANK, SAIL, IRCTC, NATIONALUM, GRANULES, GNFC, PVRINOX, PEL, and PFC stocks has the possibilities of enterance in the ban list.

MANAPPURAM, IEX, and RECLTD stocks has the possibilities of exit from ban list.

Daily Pivots

| S2 | S1 | R1 | R2 |

| 19772 | 19837 | 20008 | 20115 |

As per the above pivots data, 19830 to 20020 is the Nifty 50 trading range.

Read previous -Daily Insights- here

Market Reacts to Weak Global Cues, Ends Near Daily Low

Nifty Takes the Lead as Markets Keep Climbing

Indian Indices Survive Volatility with Marginal Gains

Revitalized Bulls Take Charge of the Market, Pushing Nifty Beyond the 20,000 Milestone

This article is only for educational purposes and is not an investment advice.