| Index | Price | Change | % Chg |

| Nifty 50 | 19,347.45 | +4.80 | +0.02% |

| Nifty Bank | 44,232.60 | –262.65 | -0.59% |

| BSE SENSEX | 65,087.25 | +11.43 | +0.02% |

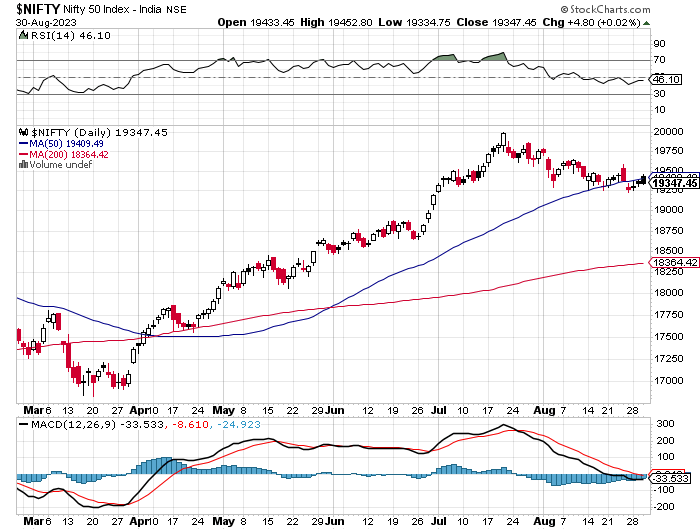

At the close, the Nifty 50 was at 19,347.45 up by 0.02%

Turbulent Yet Steady markets showcased volatility but ultimately closed with minimal change, reflecting mixed signals that defined the trading day. An early gap-up start set the tone, Nifty moving within a confined trading range. However, selling pressure in the final hours erased gains, leaving the indices almost unchanged.

Positive Momentum Amid Volatility Indian equity indices extended gains for the third consecutive session, navigating through a volatile backdrop ahead of the monthly F&O expiry. The NSE Nifty 50 commenced on a high note, registering a marginal 0.02% increase and maintaining positive momentum throughout the session. The day’s closure saw Nifty hovering around 19350.

Supportive global cues paved the way for a gap-up start, with sustained gains attributed to widespread sectoral buying. Yet, a late-session downturn diminished intraday advances. Initially fueled by favorable US labor market data, which eased concerns over rate hikes, positive sentiment buoyed the domestic equities.

Global Weakness Softens Gains as the day progressed, the positivity was softened due to global market weaknesses linked to lackluster economic data from Europe. These external factors played a role in constraining the market’s upward trajectory.

Bank Nifty: Down by 0.59%

The Bank Nifty started on a positive note but experienced a decline of 0.59 percent, ultimately closing in the red at 44,232.60. This downturn impacted banking stocks, contributing to the negative performance. Conversely, the BSE Sensex exhibited a marginal 0.02 percent increase and managed to close in the green at a notable high of 65,087.25. The index displayed a relatively steady performance despite the market’s fluctuations.

Amid these market dynamics, the banking sector faced the impact of the downturn, witnessing declines. In contrast, mid- and small-cap segments showcased resilience, highlighting their ability to navigate and potentially capitalize on market uncertainties.

In the sectorial performance, Realty sector, there has been a notable gain of 1.42%. Two prominent players, Prestige Estates Projects Ltd. and Mahindra Lifespace Developers Ltd., stand out with significant gains of 5.53% and 4.44%, respectively. Conversely, the Financial Services sector experienced a setback, with a decline of 0.50%. Notably, the State Bank Of India recorded a loss of -1.28%, while Muthoot Finance Ltd. followed with a decline of -1.07%.

Bank Nifty

The Nifty Banking sector had some gainers and some losers for the day.

The gainers included IDFC First Bank with a 2.21% increase, Punjab National Bank with a 0.56% increase, Bank of Baroda with a 0.44% increase, and Axis Bank with a 0.03% increase. On the other hand, the biggest losers in the sector included Bandhan Bank with a 2.04% decline, State Bank of India with a 1.28% decline, ICICI Bank with a 0.96% decline, Federal Bank with a 0.76% decline, and Kotak Bank with a 0.73% decline. These results suggest that some banking stocks performed better for the day.

Buzz

Rupee’s Initial Gains the trading session commenced with the rupee showcasing slight gains, opening near 82.65 with a 0.09rs increase.

Gradual Decline Amid Oil Prices the rupee’s initial gains were gradually eroded, and it was last observed at 82.71. The ascent of crude oil prices during the session added to the pressure on the rupee’s performance.

Anticipation of US Data Releases this week holds significant importance due to upcoming data releases from the US, including GDP data scheduled for this evening. Market expectations are geared towards a more favorable GDP figure of 2.4%, an improvement from the previous reading of 2.00%.

Impact on Dollar and Rupee the outcome of this data release is poised to exert a considerable influence on the dollar’s performance. A more robust GDP figure could bolster the dollar’s strength, whereas a figure falling short of expectations might induce dollar weakness, potentially benefiting the rupee.

Amid these dynamic factors, the rupee’s expected trading range is likely to span between 82.50 and 82.90. Market participants will keenly observe the data releases and ensuing market sentiment, strategically assessing possible shifts in the USDINR pair.

Buzzing

Tata Steel Ltd.’s share price has surged by 2.09% from its previous close of Rs 119.55 to a last traded price of Rs 122.05. This upward movement highlights the company’s resilience and investor confidence in its prospects. Tata Steel Ltd. has showcased remarkable growth, boasting a 3-year return of 177.23%. In comparison, the Nifty 100 index achieved a return of 63.2% during the same period. This outstanding performance underscores the company’s ability to outpace broader market trends.

A 20-day moving average crossover emerged recently, potentially signaling a shift in short-term trends. Historical data indicates an average price gain of 3.84% within 7 days of this signal over the last 5 years, offering insights for potential short-term traders. Tata Steel Ltd. experienced a sales de-growth of 0.14%, marking its first revenue contraction in the last 3 years. Additionally, historical data reveals that only 2.57% of trading sessions in the past 18 years witnessed intraday gains higher than 5%.

Power Grid Corporation of India Ltd. saw a -1.49% decrease in its share price from the previous close of Rs 251.15 to a last traded price of Rs 247.40. This decline reflects the evolving market dynamics and investor sentiment. Over the past 3 years, Power Grid Corporation of India Ltd. delivered a return of 81.75%, outperforming the Nifty 100 index, which achieved a return of 63.2%. This signals strong performance, potentially attracting investors seeking stable returns.

On August 28, 2023, a 50-day moving average crossover occurred, suggesting a potential shift in short-term trends. Historical data indicates an average price gain of 4.95% within 30 days of this signal over the last 5 years, offering insights for short-term traders. The company experienced a quarter-on-quarter (QoQ) revenue decline of 10.35%, marking the lowest in the last 3 years. Additionally, historical data reveals that only 1.07% of trading sessions in the past 16 years saw intraday gains higher than 5%.

Advance Decline Ratio

Today, the advance-decline ratio was 1.73, and the market breadth was positive. The volatility index India Vix decreased by 3.47 percent to settle at 11.80 and the FIIs were net sellers today.

DAILY MARKET ACTION

Advancers – 1476

Decliners – 855

52Wk High – 136

52Wk Low – 7

High Band Hitters – 88

Low Band Hitters – 29

200d SMA – 18364

50d SMA – 19409

20d SMA – 19433

Top Gainers and Losers Stocks

The top gainers were Jio Financial (+4.99%), Tata Steel (+2.09%), Maruti (+1.75%), Eicher Motors (+1.24%), and M&M (+1.19%).

The top losers were Power Grid (-1.49%), BPCL (-1.49%), Hero MotoCorp (-1.42%), Dr. Reddy (-1.31%), and SBIN (-1.28%).

Top Gainers and Losers Sector

The top gainers sectors were Realty (+1.42%), Metal (+0.92%), IT (+0.77%), Auto (+0.64%), and FMCG (+0.57%).

The top losers sectors were Financial Services (-0.50%), and Oil & Gas (-0.34%).

The Nifty Midcap 50 was up by 0.86 percent, while the Nifty Small Cap 50 was up by 1.35 percent on the day.

The Nifty Midcap 50 index currently closed at 11,205.35, while the Nifty Small Cap 50 index currently closed at 5,599.05.

SECTORS – NOTABLE ACTION

REALTY +1.42%

METAL +0.92%

IT +0.77%

FINANCIAL SERVICES -0.50%

OIL & GAS -0.34%

Stocks Ban List

(SEBI) F&O ban list (IBULHSGFIN open at -189.55 and close at +193.30), (ESCORTS open at +3046.00 and close at +3252.75), (SUNTV open at +604.20 and close at +613.45), (RBLBANK open at +234.10 and close at +241.15), (GMRINFRA open at +61.55 and close at -60.25), (HINDCOPPER open at +153.00 and close at +154.65), (MANAPPURAM open at +147.30 and close at +148.90) are not currently on the stock exchange.

A stock enters the Ban List if its MWPL is above 95%. Implying that, Ban List shows the Futures and Options (FnO ) stocks whose combined open interest in all FnO contracts for a given period crosses 95% of Market-Wide Position Limit.

ZEEL, PEL, BALRAMCHIN, SAIL, PNB, DELTACORP, RECLTD, and INDUSTOWER stocks has the possibilities of enterance in the ban list.

SUNTV, RBLBANK, GMRINFRA, HINDCOPPER, and MANAPPURAM stocks has the possiblities of exit from ban list.

Daily Pivots

| S2 | S1 | R1 | R2 |

| 19260 | 19304 | 19422 | 19496 |

As per the above pivots data, 19300 to 19430 is the Nifty 50 trading range.

Read previous -Daily Insights- here

Stagnant Markets Consecutive Unchanged Sessions

Market Gains Marginally Amid Volatility & Positive Global Cues

Markets Under Pressure, Extend Thursday’s Decline

OKAYB: Gauging Crypto Market Sentiment and Assessing Bearish Trends

This article is only for educational purposes and is not an investment advice.